Streamline branch banking software

Opportunity

Modernize, streamline and simplify Wells Fargo’s 20-year-old banking platform. Tie customer authentication and management, banking tasks, procedures, and customer consent into a unified platform.

Role

Co-lead with product designer; content designer, content strategist, facilitator, and project manager.

Process

Discover: Review and digest the current state process map, branch banker feedback, banker and customer journey, and all compliance corrective actions. Understand the many back-end systems that feed and impact the task flow.

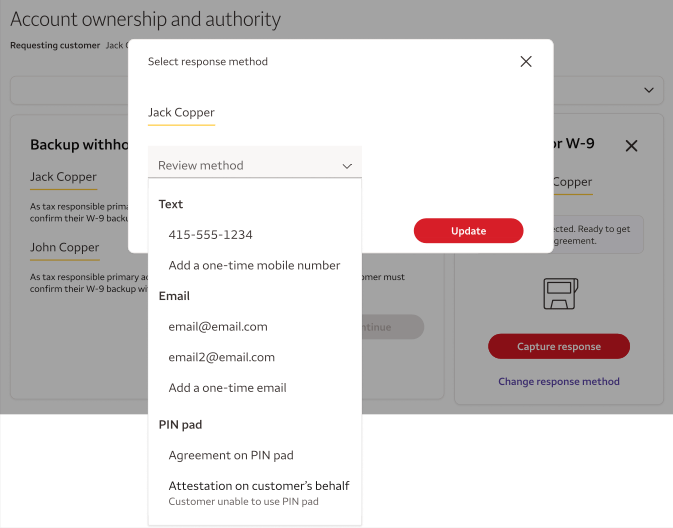

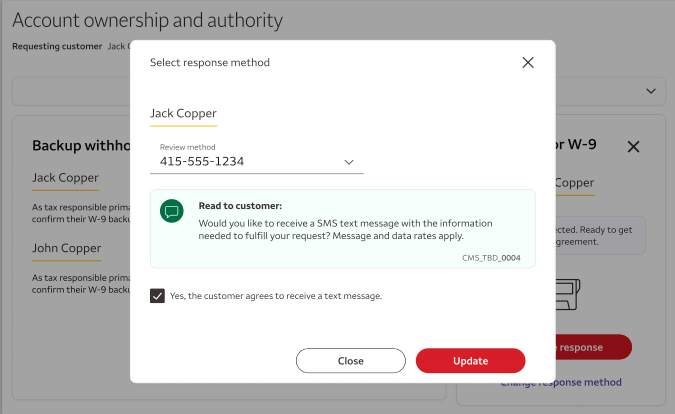

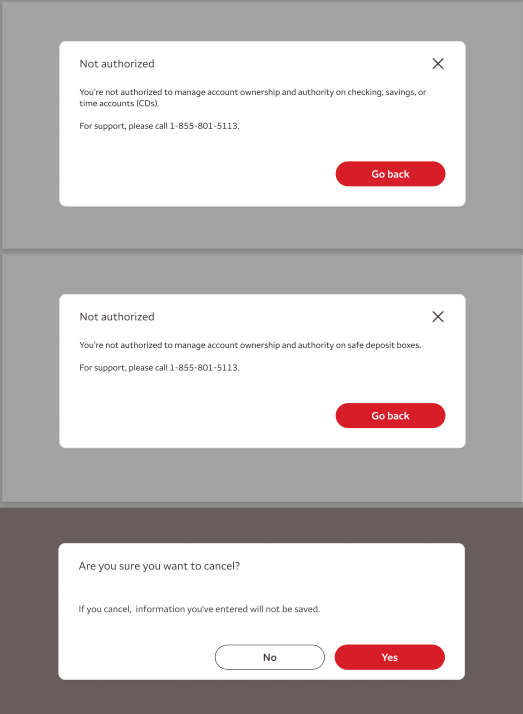

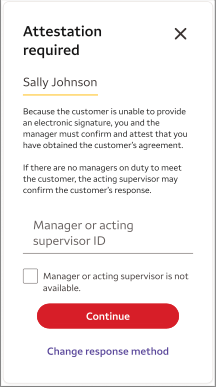

Define: Block out the main steps and use the existing consumer design kit to generate low-fidelity designs. Once higher fidelity work gets started, make design kit enhancements to support the branch modernization efforts. Reusable components: select review method and change review method, response and consent panel, print disclosures, and banker/manager attestation.

Design: Write streamlined and simplified UX copy. Keep in mind required processes and backend systems operations. Solicit feedback from design team, bankers (users), product owners, and business analysts. Iterate continuously.

Governance: Establish a way to document decisions and share reusable content for the estimated 400 tasks being rebuilt. Track the initiative’s editorial standards – down to button copy – as well as all messaging documents and designs. Reuse will help the content team be both efficient and consistent. Recommend using a content management system, as the current platform does not.

Messaging – Errors, dynamic messaging, help text, and dropdown values are the most frequently updated and time-consuming documentation. Business analysts for each system help me build this inventory, which tracks component types, triggers, processes and system notes, old and new messages. Once the copy is written and approved, it’s added to the Jira tickets for each development sprint. We’re often surprised during development that a system is interacting with our design and needs messaging.

Approvals: Content design is tricky. It must be easy to understand, yet specific and factual. It’s often governed by legal and regulatory requirements. All content is reviewed by product, process owner, legal, compliance, fraud, and risk management.

Results

Each set of designs has received rave reviews from branch and phone bankers for simplicity and clarity of use. They ask great questions, but we rely on them to focus our attention on what’s missing or could be improved. Their partnership has been invaluable.

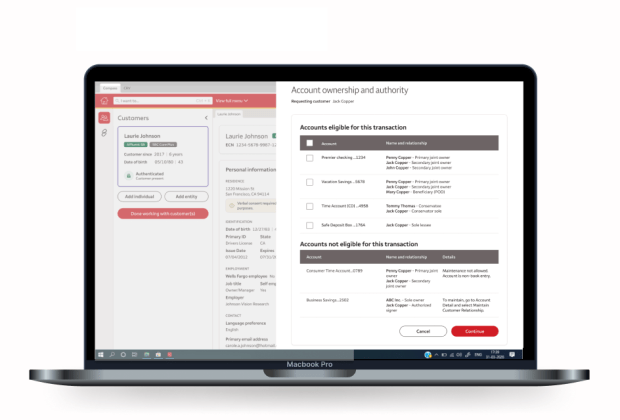

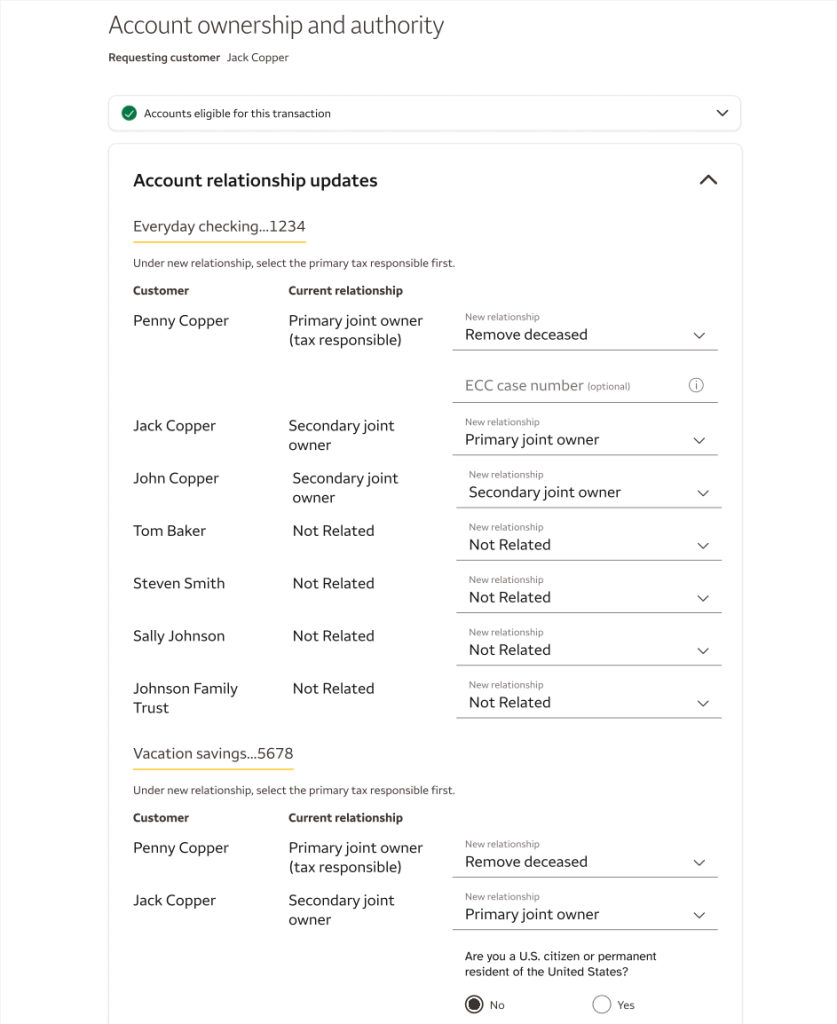

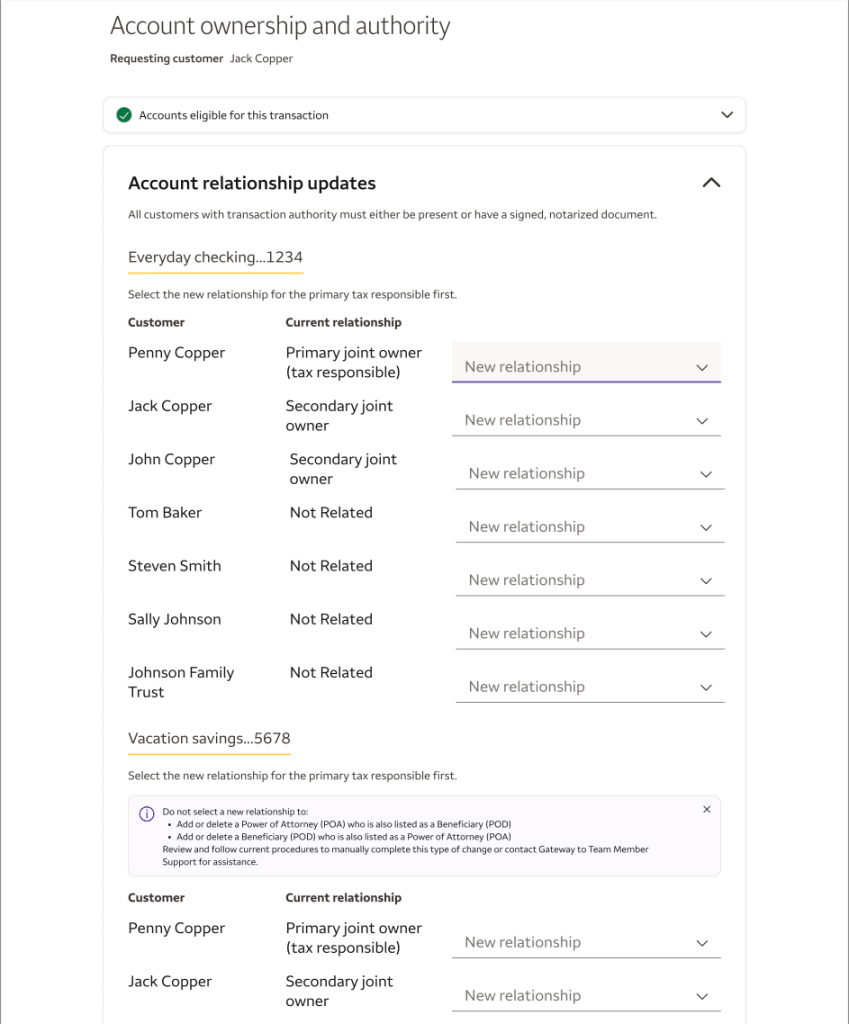

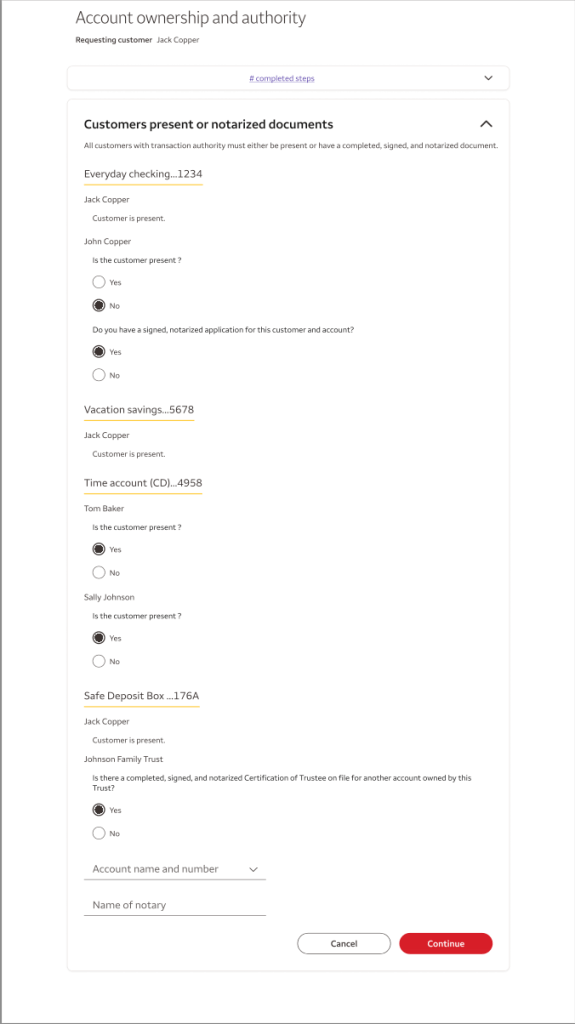

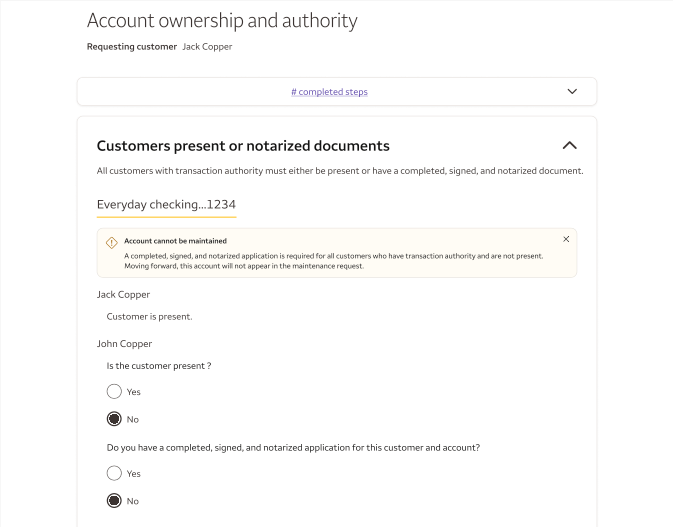

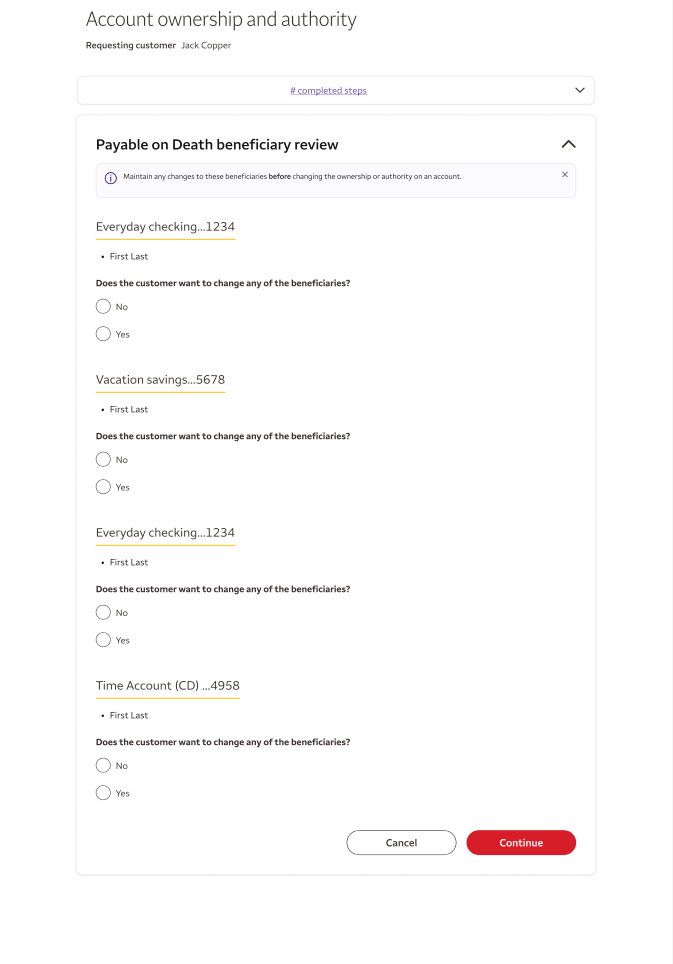

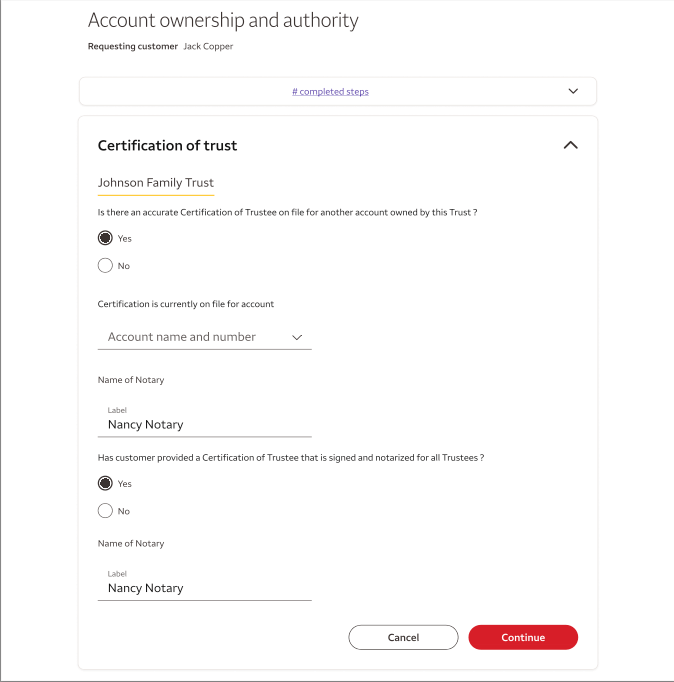

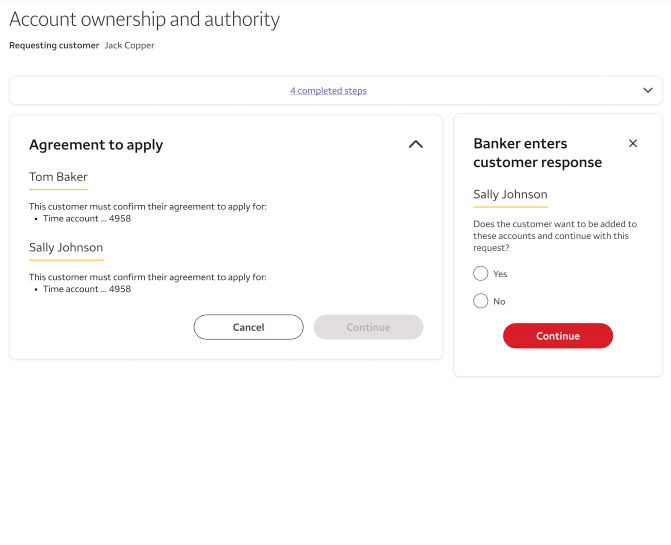

Writing samples for Account Ownership and Authority

This banker task updates the customers’ relationship to their bank accounts. It’s a complex. Being the primary, tax-responsible account holder is different than being a beneficiary. Changing the interaction requires specific steps and consent. The new design makes it easier for bank employees to make relationship updates and follow required procedures.

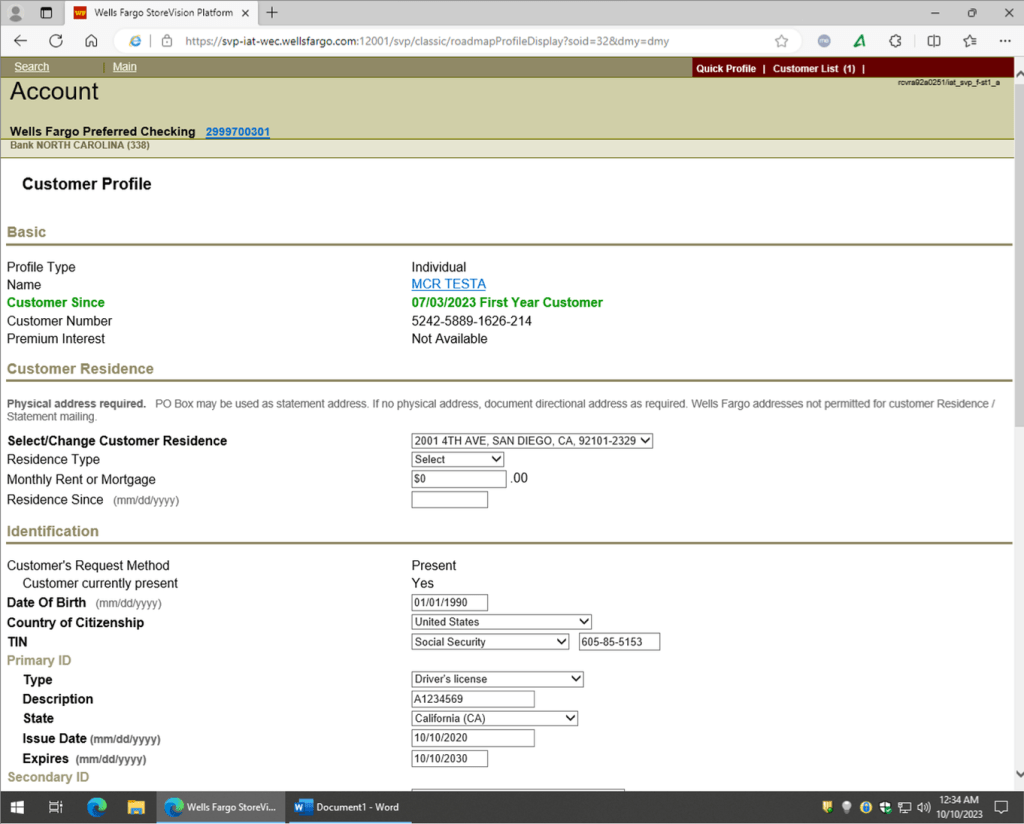

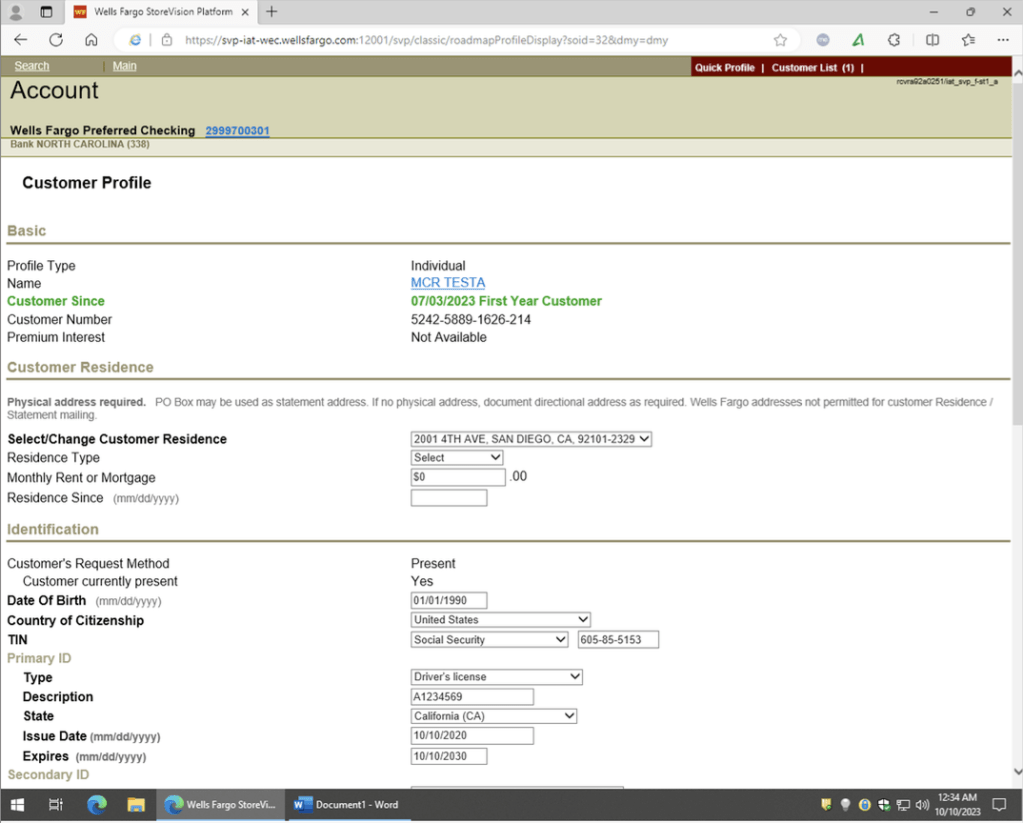

Current branch banker software

Redesigned task flow

Current software only allows one person to update one account. To update multiple accounts, the transaction needs to be replicated and authenticated for each end-to-end flow. To improve the customer experience, the product owner decided to allow for multiple account updates at the same time. The complexity of the task was challenging, as you will see in this task flow.

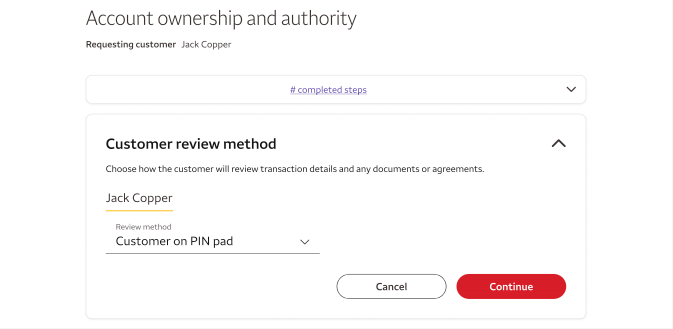

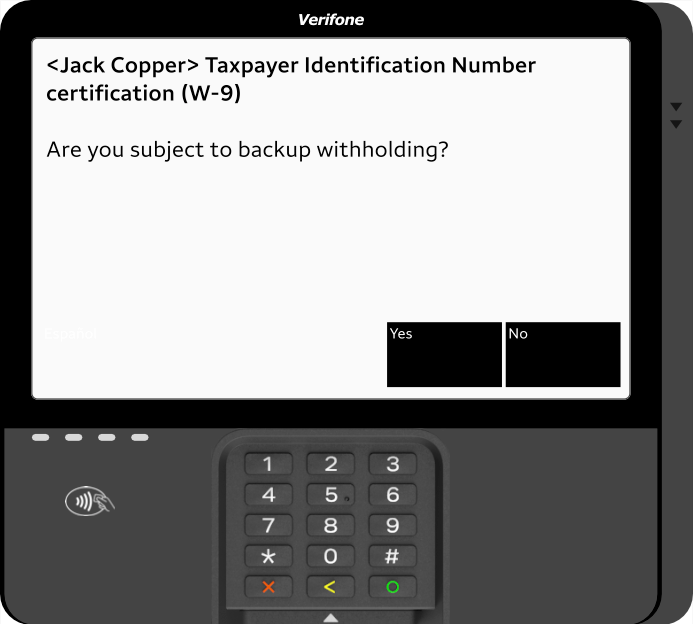

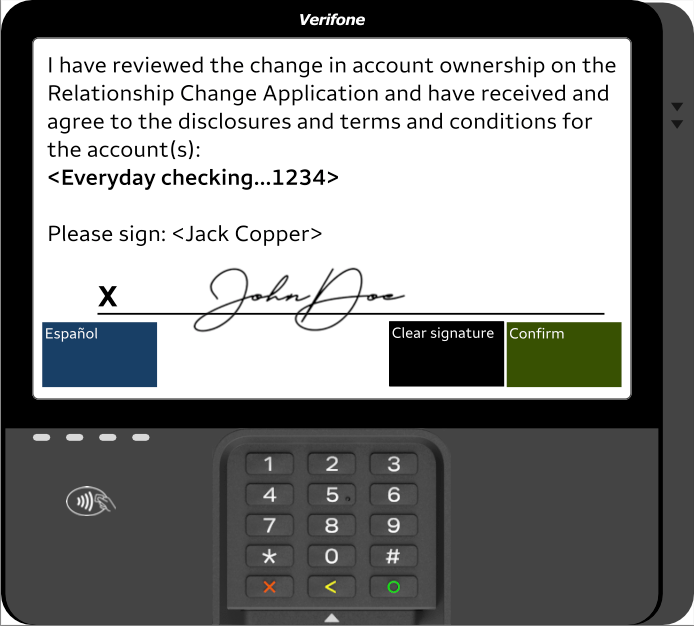

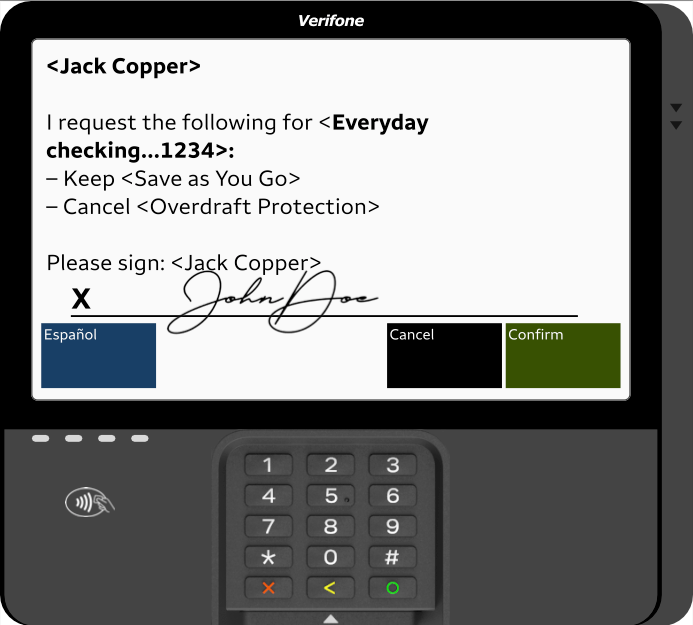

Consent screens

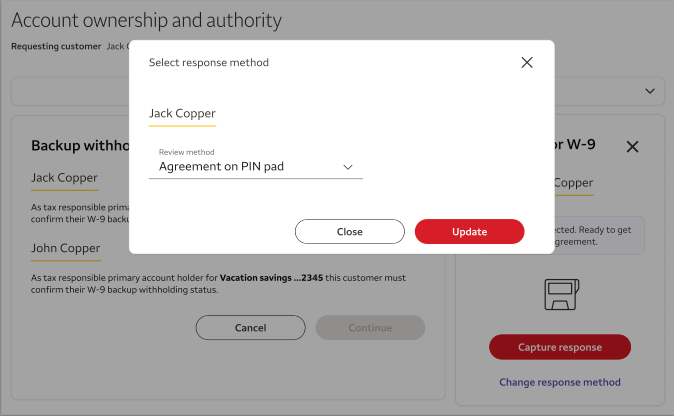

Change review method, lightbox alerts, and errors

Portfolio | Services | About me | Why “semicolon” | LinkedIn | Resume