Opportunity

U.S. Bank digital and app adoption is trailing compared to the larger banks. In 2018–19, executive leadership decided to co-locate product, UX, and dev teams to build a native application and new design kit.

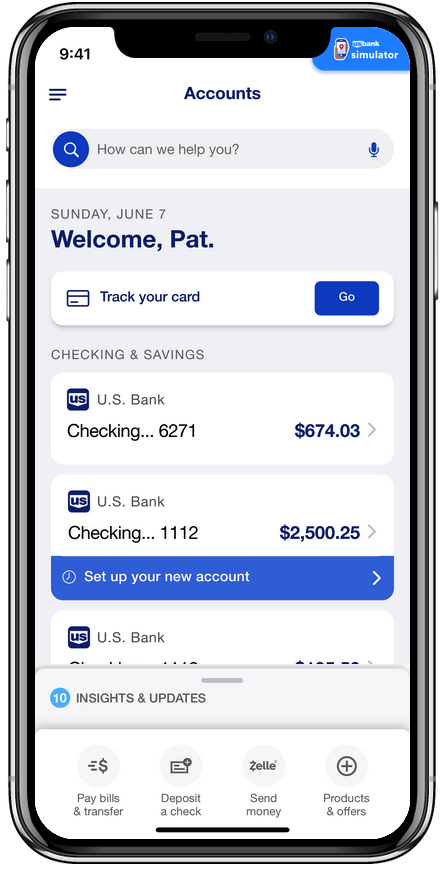

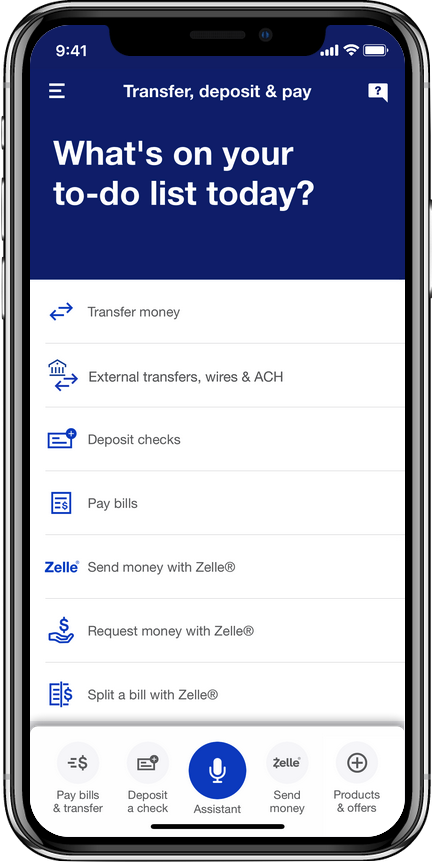

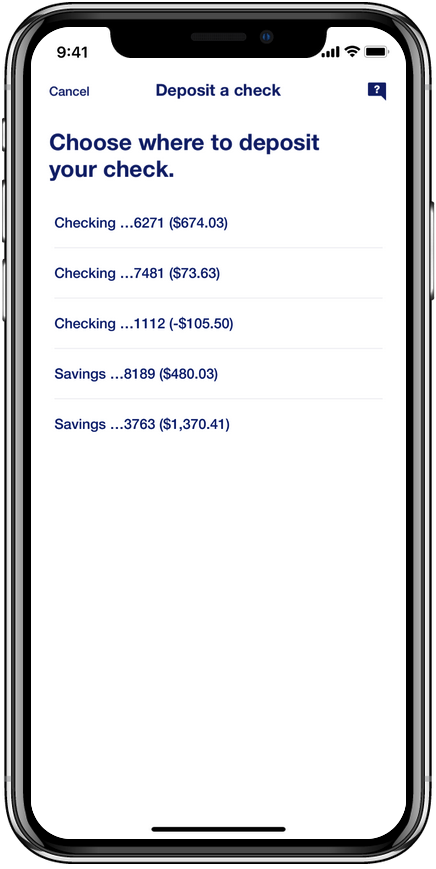

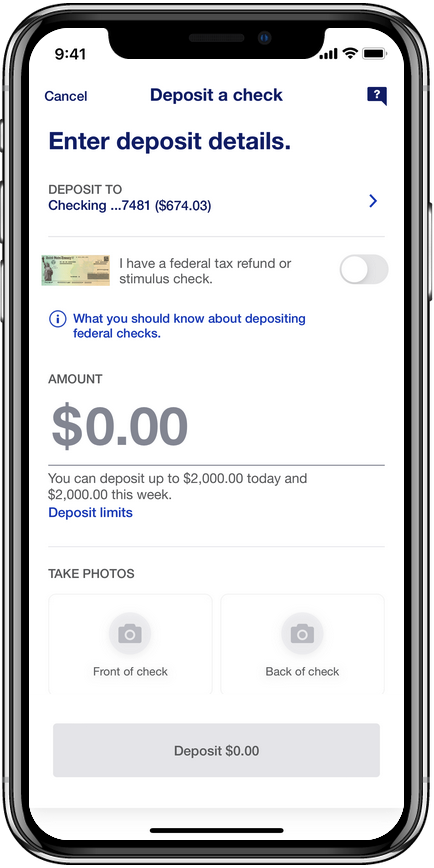

U.S. Bank digital banking simulator

Role

Understand the overall program content strategy, derive a strategy for account management, transfers, and payments, and write copy for all related transactions.

Process

Partner with product managers to understand the business needs and current task flow. Write content to simplify self-service tasks while compling with regulations. Validate that tasks are technically feasible with analysts and development team.

Results

When U.S. Bank launched its new mobile app in 2019, the goal was to provide customers with top-notch tools for managing their money. Now, almost four years later, the U.S. Bank Mobile App keeps winning awards and introducing new features to help customers reach their financial goals. Read article.

Work samples

Transfer, Deposit, and Pay

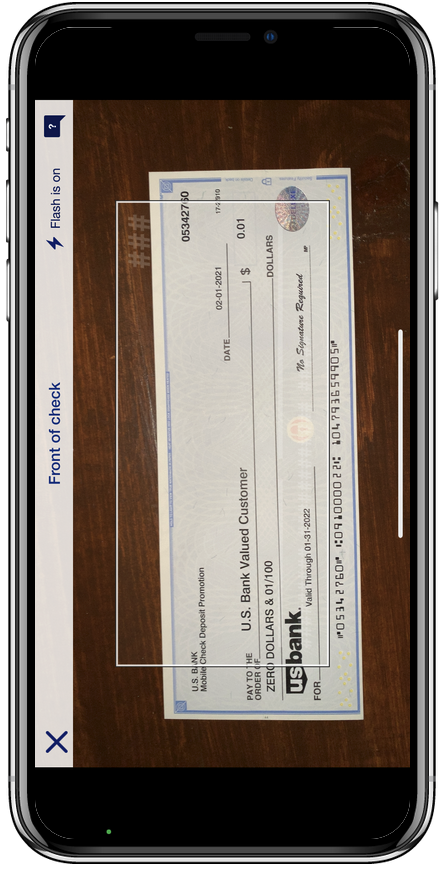

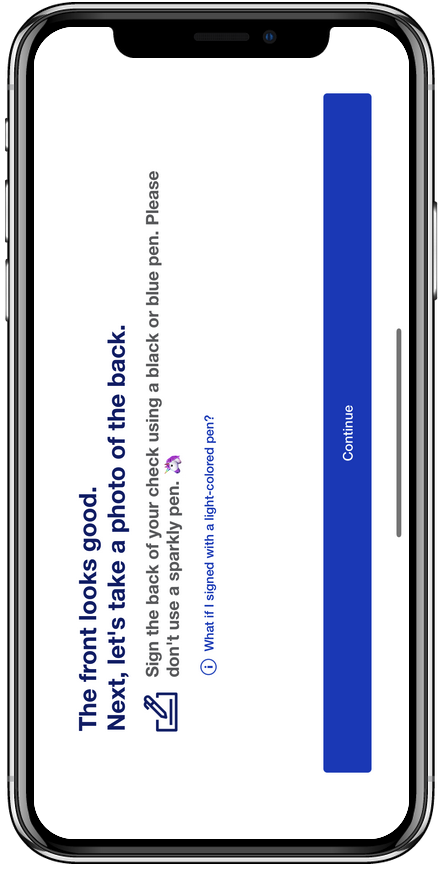

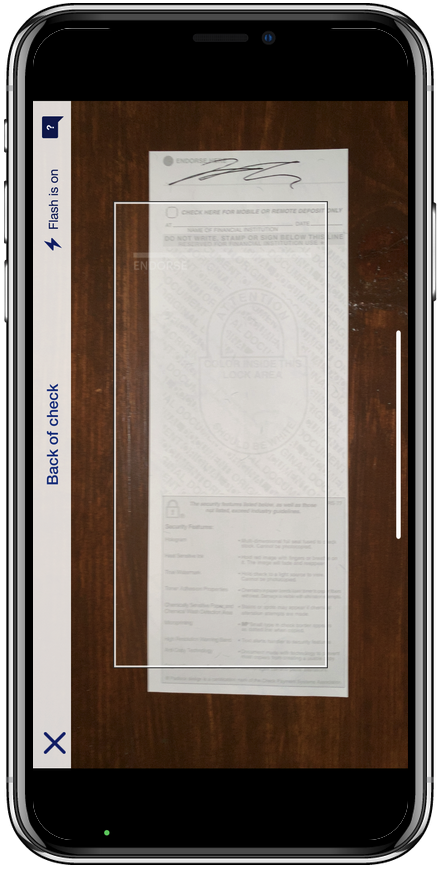

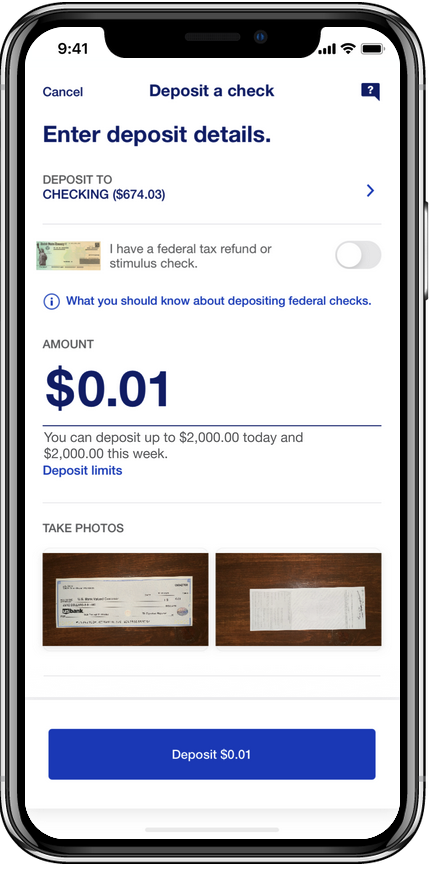

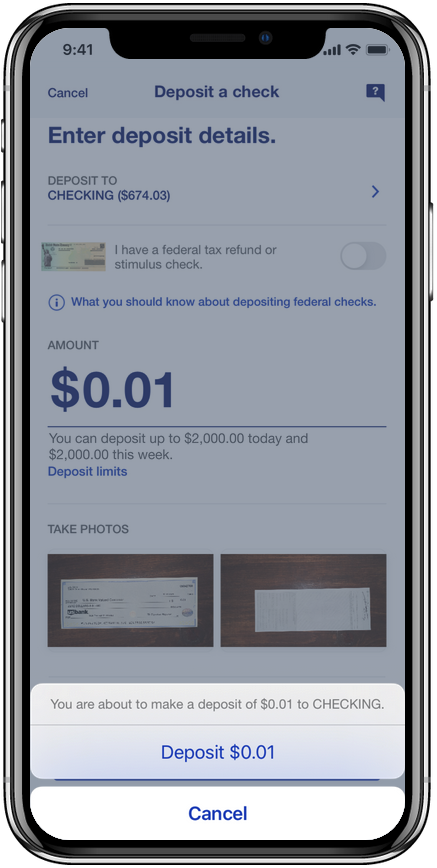

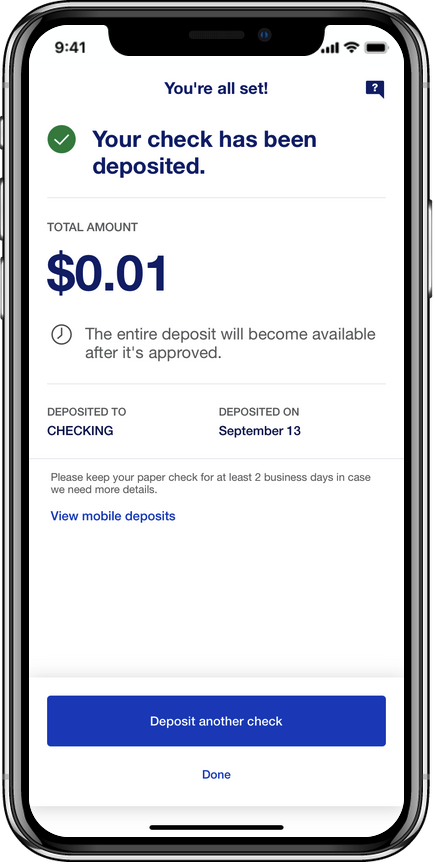

Deposit a Check

Content design for mobile deposit, all copy including error messages and disclosures. Negotiate copy requirements with legal, risk, compliance, and fraud.

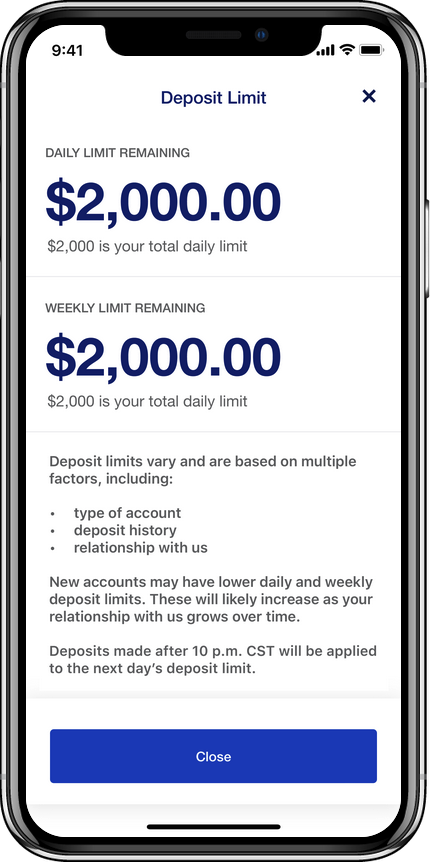

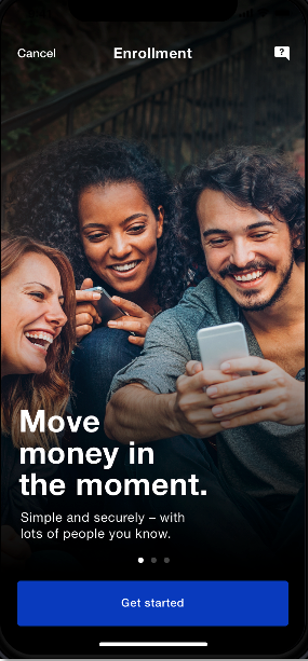

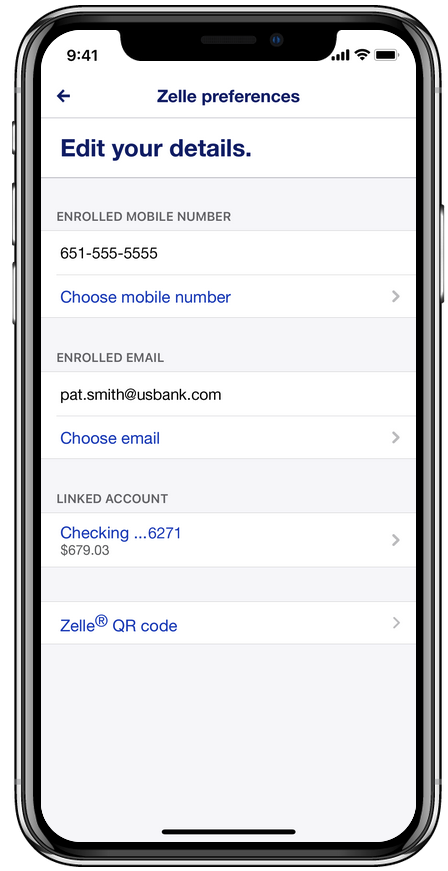

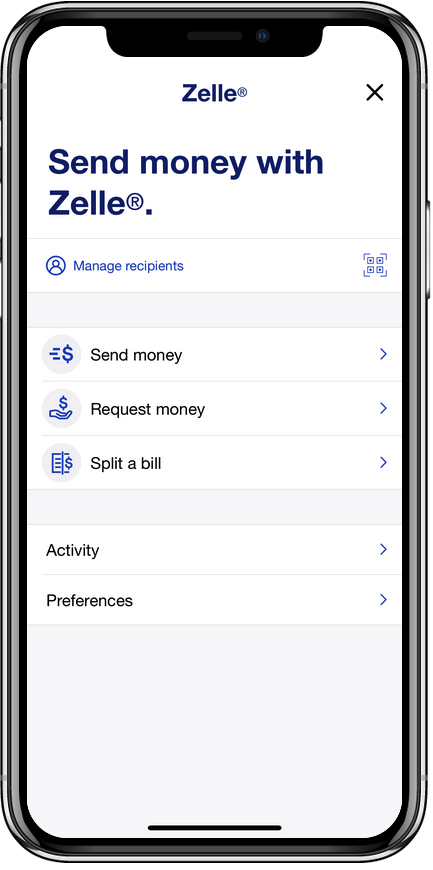

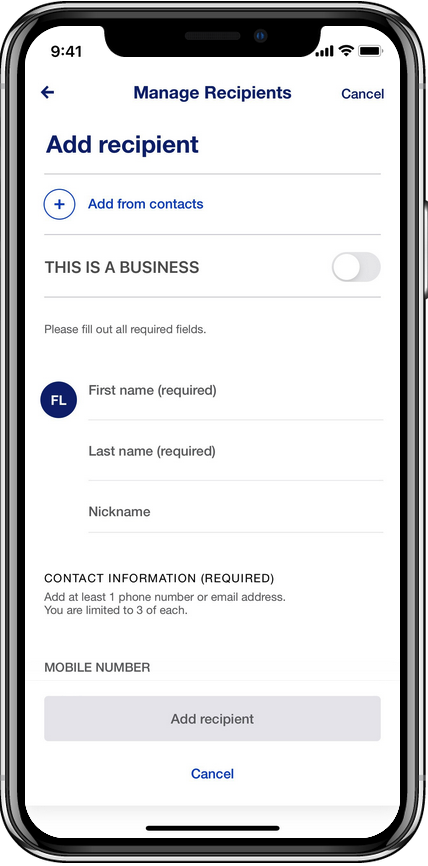

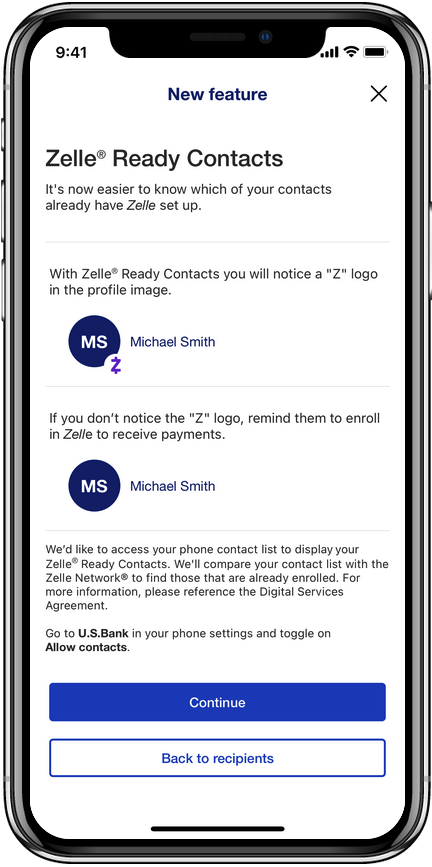

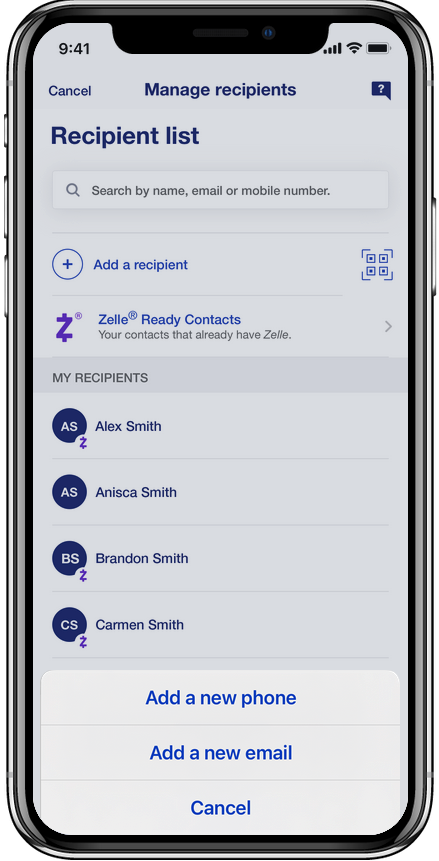

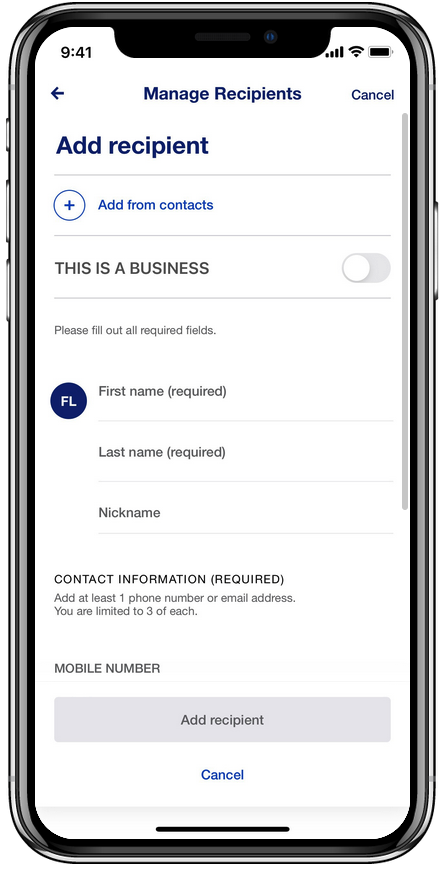

Zelle – Enrollment, Activity, and Send

Zelle Enrollment Campaign

Caurosel encouraging customers to use Zelle for person-to-person payments:

- Spend money to send money? No thanks.

An easy way to send money – fast, secure and free. - Request money from wherever you are.

Receive it fast – direct to your bank account. - Move money in the moment.

Simply and securely – with lots of people you know.

Get started

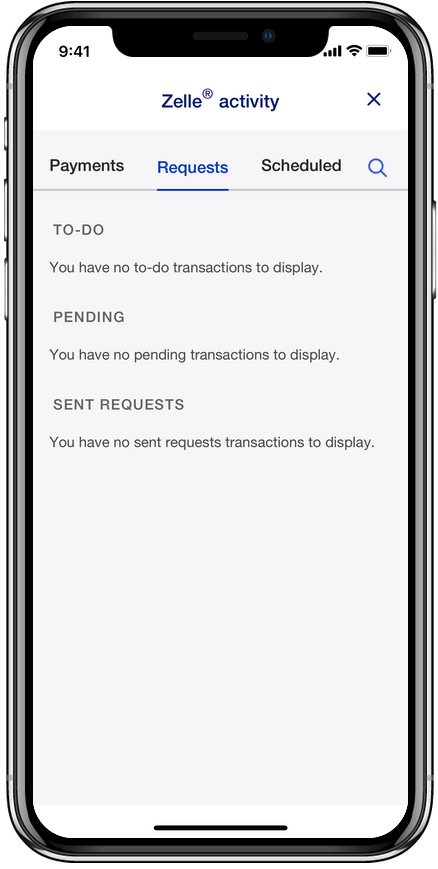

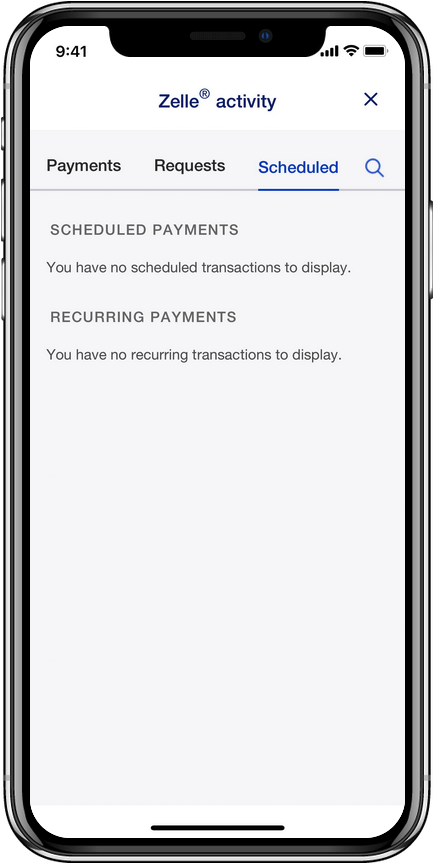

Zelle Activity

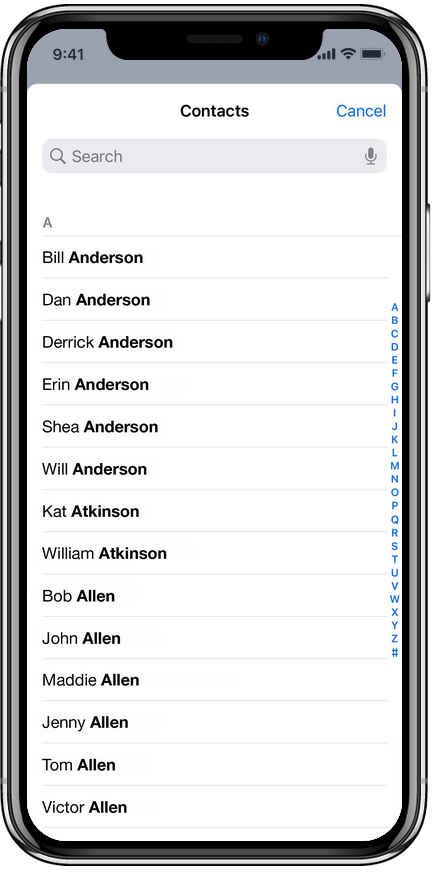

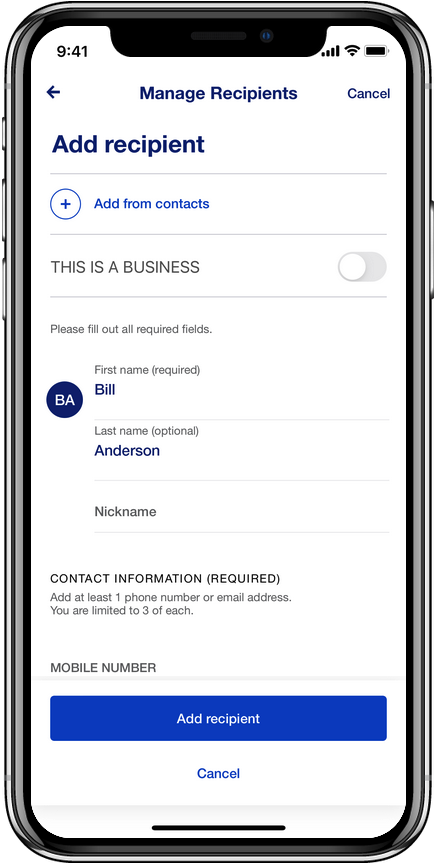

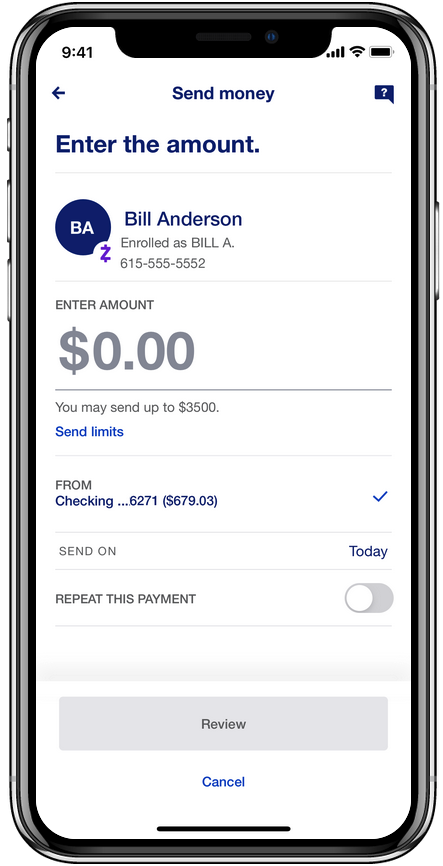

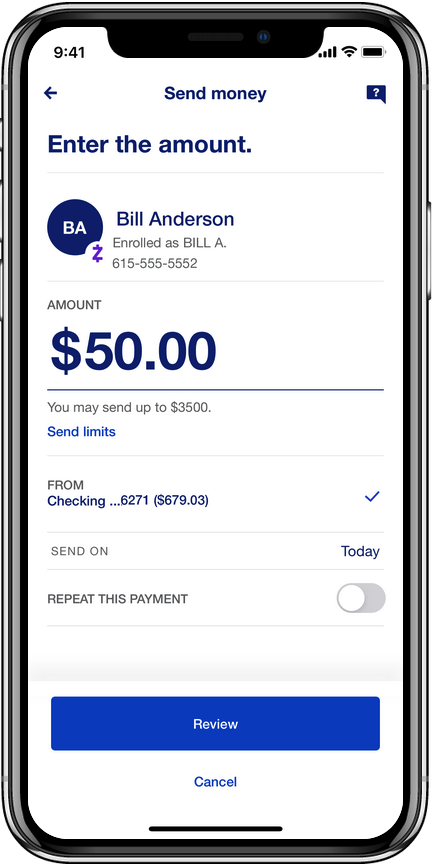

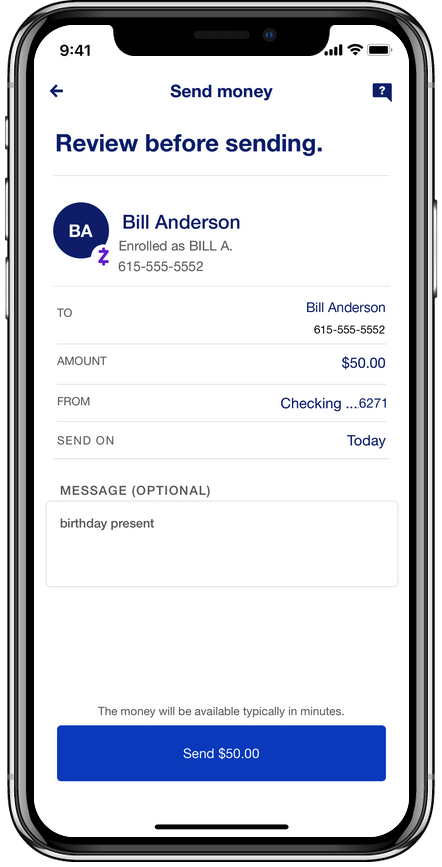

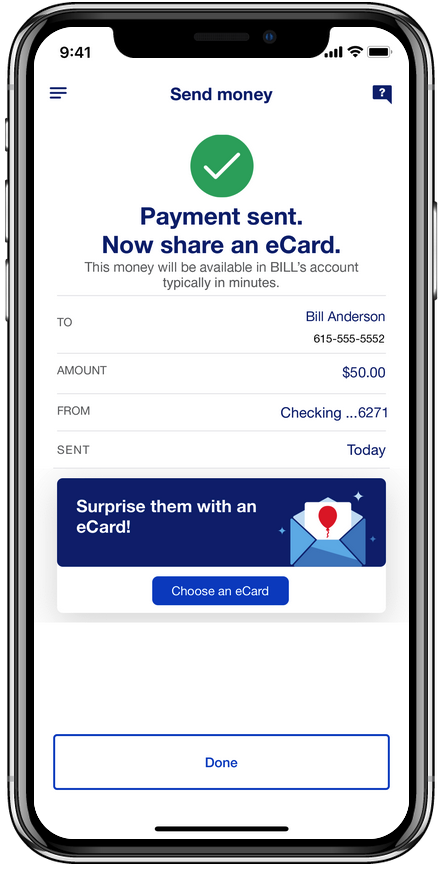

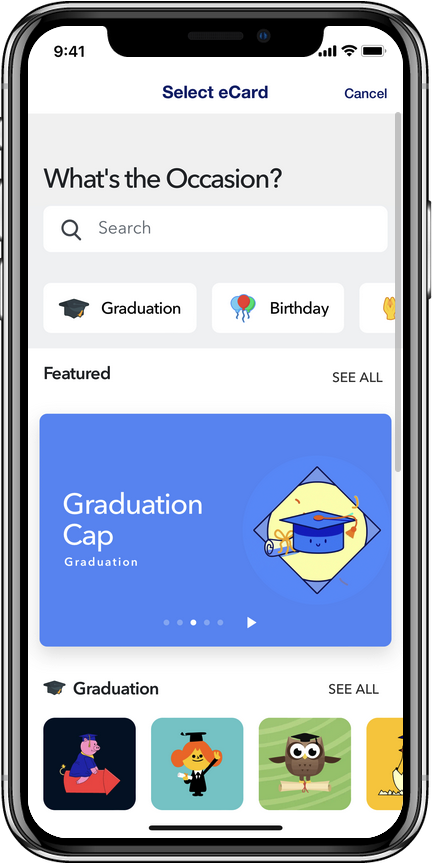

Send Money with Zelle

Sample Messages from Transfer, Deposit, and Pay

Brand voice: Friendly, helpful, and conversational

| Before | After |

| Think twice: Are you sure you want to withdraw money from [account name]. You are saving toward a S.T.A.R.T. goal and withdrawing funds from this account will affect your progress. | Transferring money from this account may affect progress toward your START Smart goal. |

| Making payments? To make a payment to your U.S. Bank account, use Payments. | Trying to make a payment? Tap Continue and we’ll help you get to the right place. Next time save yourself a few seconds, choose Pay bill to quickly make payments to your U.S. Bank account. |

| Premature distributions made before age 59 ½ may be subject to ordinary income tax and a 10% penalty. Consult with your tax advisor with questions prior to completing your transaction. | Taking distributions before you turn 59½ may incur a 10% penalty and be taxed as ordinary income. Check with your tax advisor for details. |

| Insufficient Cash Available To make a transfer in this amount, you’ll need to request a sale of assets in your Automated Investor Portfolio account. To do this, select Go To Raise Cash below, and then come back after the sale has settled. You can also reduce the transfer amount, so it doesn’t exceed your Available Cash amount. | To transfer this amount, you’ll need to request a sale of assets or reduce the transfer amount. Note: Link takes the customer to the location where they can sell assets to cover. |

| Something went wrong We’re not about to process. Please call us at 800-987-7237 for details. | Our system is not cooperating. We seem to be having trouble with Zelle. We expect this to be temporary. Please check back later. |

| For your security, some of your accounts are temporarily available. Please call 800.USBANKS (872.2657) for help. | Sending money with Zelle® is not available for your accounts. Please go to usbank.com/Zelle, or call 800-872-2657 for help. |

Portfolio | Services | About me | Why “semicolon” | LinkedIn | Resume